Blog

393MA – Blog Part 1

Unlocking the Power of Moving Averages for #swing Trading

Introduction

Moving averages (MA) are among the most trusted tools globally. The major reason is it only considers price and reduces noises of the market, which eventually helps traders find real underlying trends. This will help immediately to look beyond price, finding the right trend and price to take action.

Just to remind, more blogs with more deep insights specifically on strategies will be updated.

join our telegram channel to stay updated.

In this blog, we will discuss mainly 3 moving average setups individually and with combinations.

- 39 MA (Use in Hourly): For entry and exit levels.

- 93 MA (Use in Daily): For trend confirmation in swing trading.

- 393 MA (Use in Daily): For taking a trade of the YEAR.

1. What Are Moving Averages?

A moving average smoothens the price which also means the removal of unwanted spikes and create a single flowing line. This line helps traders filter out market noise and focus on the real trend.

Widely known Types of Moving Averages

- Simple Moving Average (SMA): Averages prices equally.

- Exponential Moving Average (EMA): Assigns more weight to recent prices, making it more sensitive to price changes.

For this strategy, we will only focus on 393 SMA.

2. Why These Parameters?

The stock market is the house of volatility which leads to loss due to impulsive decisions, to overcome this we have tested many many values and finally selected 39, 93, and 393 MAs for this strategy.

39 MA (Hourly Time frame)

- Captures short-term price movements for taking quick entry and exit.

- This time frame is Ideal for quick momentum trades.

- Consolidation is the biggest enemy here, and this time frame will protect partially.

93 MA (Daily Time frame)

- We prefer this for only focusing on bigger swings for big profits and lesser trades.

- Trend confirmation is a very important criteria in this strategy where we dont need quick and fake signals.

- Time-tested time frame for swing trading and trend-following strategies.

393 MA (Multi-Year)

- Represents multi-year price trend reversal point.

- Perfect if we want to accumulate a stock in a long downtrend.

- Helps us to scan quality stocks available at discounted prices and ready to perform.

3. How to Use 39, 93, and 393 Moving Averages

Strategy 1: Counter-Trend Trading with 39 MA (Hourly)

- Use the 39 MA on the hourly timeframe.

- Take every trade based on the signal confirmation from the 39 MA.

- Ignore higher timeframe confirmations.

- Best suited for counter-trend trades after a big spike in stocks near key trend reversal areas.

Strategy 2: Directional Trading with 93 MA (Daily)

- Use the 93 MA on the daily timeframe for trend direction confirmation.

- Trade only in the direction of the 93 MA.

- Entry and exit points are based on the 39 MA from the hourly timeframe.

- Do not take trades in the opposite direction unless confirmed by both timeframes.

Strategy 3: Long-Term Investments with 93 and 393 MAs

- Use the daily timeframe with both 93 MA and 393 MA.

- Buy only when the stock trades below 393 MA and crosses above it later.

- For trailing stop-loss, use the 93 MA to protect profits.

- Ideal for short to long-term investments in the equity segment.

These strategies are simple, actionable, and easy to implement in your trading routine. Apply them consistently for optimal results.

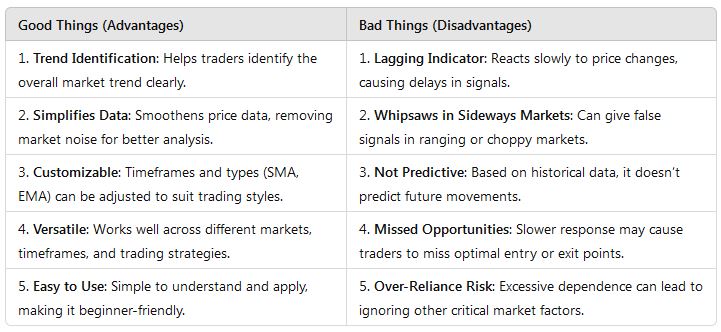

4. Advantages and Disadvantages of Using Moving Averages

5. Case studies

Example 1: NIFTY

- Scenario: Analyzing NIFTY from 2015–2023 using the 393 MA.

- Observation: NIFTY stayed above the 393 MA during strong bull markets. In 2020, it dipped below, signalling a bear market.

- Actionable Insight: Long-term investors could confidently re-enter above the 393 MA.

Example 2: Reliance Industries

- Scenario: Using the 93 MA to swing trade Reliance.

- Observation: Reliance consistently bounced off the 93 MA during its uptrend in 2021.

- Actionable Insight: Traders could use these bounces as entry points with a target of 5% profit.

Example 3: TATA Motors

- Scenario: Using the 39 MA on an hourly chart during volatile trading sessions.

- Observation: Price action consistently reverted to the 39 MA during pullbacks.

- Actionable Insight: Quick trades were possible during these pullbacks with tight stop-losses.

6. Homework for Traders

Ready to apply what you’ve learned? Here’s your challenge:

- Select your favourite stocks from the NIFTY 50 or NIFTY Midcap.

- Apply the 39, 93, and 393 moving averages as not all stocks give equal profits.

- Share your findings in the comments.

For a deeper understanding, join our RECO community.

7. Why RECO is Your Next Step

RECO – Reboot 2.0 | Community by Mitul Mehta is your gateway to mastering moving averages and more.

What You Get:

- Nifty -MAGIC- Levels: Precise levels to trade NIFTY confidently.

- Swing Opportunities in Stocks: Real-time updates on the best trades.

- High Dividend Stock Reports: Secure your portfolio with strong dividend players.

- Reboot Swing Lectures: Master swing trading step by step.

What’s More?

- Lifetime Free Membership: Learn at your pace without worrying about fees.

- No Tips, No Calls, Only Learning: Build knowledge, not dependency.

- Real-Time Case Studies: See strategies applied in real-world scenarios.

Start now Visit RECO.

8. Bonus: Learn More with Our YouTube Series

For a hands-on walkthrough, explore our YouTube videos:

Lecture 1

Lecture 2

Lecture 3

Conclusion

Moving averages are simple yet powerful tools. The 39, 93, and 393 parameters provide clarity and confidence for Indian stock market traders. By combining them with the strategies outlined here and leveraging the RECO community, you can take your trading to the next level.

Don’t forget to share this blog with friends and family—it’s time to make moving averages a part of every trader’s toolkit!

Start Your Journey Join RECO Now